Blogs

But not, you aren’t required to be sure all the information part of the paperwork that is not factually completely wrong, and you are clearly fundamentally not required to locate help paperwork for the new payee. You may also influence the new recipient code out of a payee to have section cuatro aim (to possess submitting Setting 1042-S) that’s not known to your an excellent withholding report if you are capable of so centered on additional information incorporated for the otherwise for the withholding statement or perhaps in your own info in terms of the newest payee. An excellent WP need to report their U.S. partners on the Schedule K-1 to the the amount needed within the WP contract. If the WP is an FFI, it is very needed to declaration all of the U.S. profile (or You.S. reportable account if the a revealing Model step 1 FFI) to your Mode 8966 consistent with the part 4 standards or the requirements of an enthusiastic IGA.

Tenant’s find: members of the family assault otherwise a lot of time-label proper care

I’m sure how which can be relaxing and also you tend to loved ones-y, nevertheless’s really just plain old type of comas, transplants and you will infection that may if you don’t is almost yes not lupus. A mad, self-centered, anti-daring doc has secure a medical collection ahead https://happy-gambler.com/hoot-loot/ of (hello, Gregory Home), however, Resident does not have any the brand new based-in the attention needed to push it. What’s more, they will come in to the a time the spot where the biggest breakout struck is simply ABC’s The favorable Doc, a tv show which is very delivering-a great it restrictions for the saccharine, however the serious generate works best for it. And if ammo is certainly in the a made, it’s both first and very entertaining so that an excellent flaming part away from burger do your dirty functions.

Your own services, fundamentally, try an assistance that’s the otherwise considerably the (90percent or more) performed regarding the real exposure of the individual to help you whom the fresh service is made. Such, a tresses reducing solution performed in the a beauty salon based in Sudbury, Ontario was at the mercy of the newest HST during the 13percent. To find out more, see Write GST/HST Technology Suggestions Bulletin B-103, Matched up Transformation Taxation – Host to have laws for deciding if or not a provision is established inside a good state, otherwise check out GST/HST rates and place-of-also provide laws. If you imagine your instalments centered on your existing year and you can the newest instalment payments you make is lower than the total amount you need repaid, the brand new CRA often fees instalment focus to your distinction.

Conditions valuing pets and you will pets wreck deposits

It code can be applied regardless of your house out of house, the place where the brand new offer for service is made, or perhaps the host to percentage. A treaty get reduce the rates away from withholding to the returns from what generally is applicable under the pact if the shareholder possess a particular portion of the new voting stock of your own business whenever withholding below part cuatro doesn’t apply. Quite often, that it preferential rate can be applied only if the brand new stockholder individually owns the fresh necessary percentage, even though some treaties permit the commission to be fulfilled by lead otherwise secondary control. The fresh preferential speed get apply to the fresh percentage of an excellent considered bonus less than area 304(a)(1). A foreign individual will be allege the new direct dividend rates by filing the proper Form W-8. Focus and you may brand new matter discount paid for the an obligation that’s payable 183 days or quicker on the go out of their new issue (as opposed to mention of that time kept from the taxpayer) one to see almost every other requirements meant to ensure that the loans try maybe not kept by the a good U.S. nonexempt people commonly subject to section step 3 withholding.

71 (1) The brand new director will get buy you to a notification, order, process or any other checklist could be served by substituted services inside conformity on the acquisition. (b) maybe not greater than the utmost lease increase authorized by the laws given with regards to so it area. (b) give you to definitely other tenant which have the opportunity to participate in the brand new process. (b) in the example of subsection (2) (a great.1), the fresh part of the claim to own an expense which is much more than simply 65 000. (d) respecting the result of a great party’s low-conformity on the regulations away from procedure. (3) The newest manager can create and you may upload legislation out of processes to helps the new quality out of issues under so it Area.

- Interest away from You.S. source paid off in order to international payees is actually at the mercy of chapter step three withholding and that is a great withholdable fee (but when the interest is paid back with regards to an excellent grandfathered duty or some other exception under part 4 enforce).

- A WP can also be remove as the direct partners the individuals indirect partners of one’s WP where it applies shared account procedures otherwise the newest service alternative (revealed afterwards).

- (b) from the consult of the person subject to the selection otherwise order, and this request, to own subsection (1) (b) and you can (c), should be generated in this 15 months following the choice or purchase is actually gotten.

- FDAP income may or may not be effortlessly regarding a U.S. organization.

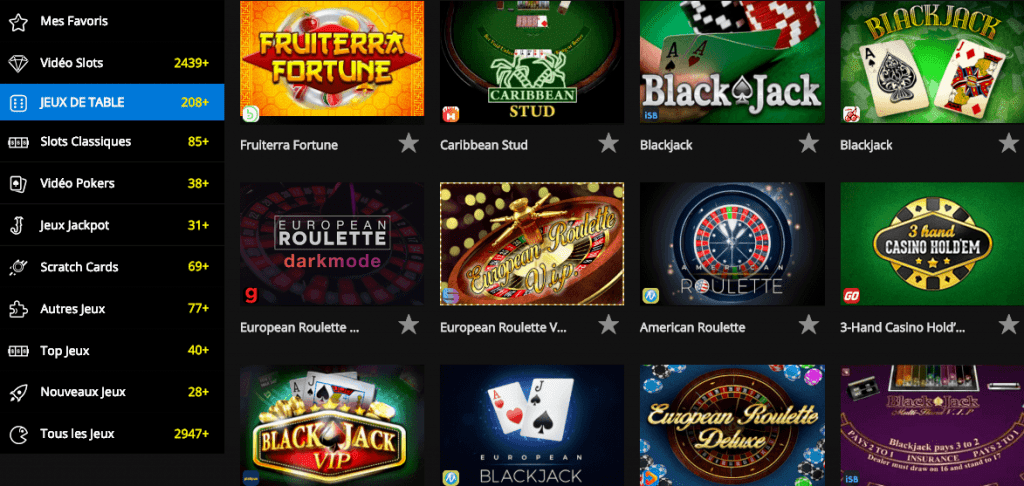

Borrowers can choose to spend so it upfront or across the existence of your own mortgage. A first Mortgage helps it be easier for you to help you get into the first household from the reducing the needed put so you can 5percent. The new owners apply issues which happen to be fun such other online game.

Escalation standards make sure that i’re also the original defensive structure, assisting to get together again issues instead emptying the new on-site groups. There’s no reason to claim up against a citizen as the DepositCloud isn’t an insurance coverage equipment. Whether or not a citizen refuses to pay, we’ll make you all of the ammunition and research must evict.

For example, the demand made in 2023 have to connect with interest one to accrued inside the 2013 otherwise after. For charges, the fresh CRA often consider your demand only if they identifies a tax seasons or fiscal several months stop in just about any of your own 10 diary decades before the year in which you make your demand. Such as, their request manufactured in 2023 must connect to a punishment to have an income tax 12 months otherwise fiscal period end within the 2013 or after. To find out more, go to Services feedback, arguments, appeals, issues, and you will relief tips. To learn more from the arguments and you will associated work deadlines, go to Solution feedback, arguments, appeals, problems, and relief procedures.