Once entered, the general journal provides a chronological record of all non-specialized entries that would otherwise have been recorded in one of the specialty journals. Journal entries are the first step in the accounting cycle and are used to record all business transactions and events in the accounting system. As business events occur throughout the accounting period, journal entries are recorded in the general journal to show how the event changed in the accounting equation.

Step 3 of 3

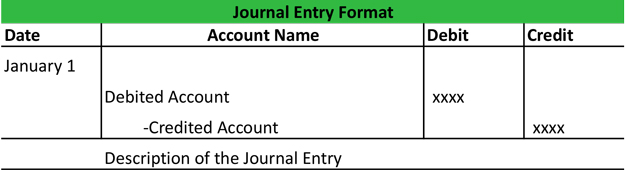

It has become a widespread practice to enter the debits first, followed by the credits and then the narration, though this is not a requirement. Nevertheless, whatever format you’ve adopted for your general ledger should be applied consistently. We’ve gone through 15 journal entry examples and explained how each are prepared to help you learn the art of recording. Feel free to refer back to the examples above should you encounter similar transactions. Regularly reviewing entries in the general journal is crucial for maintaining accurate financial records. This practice allows for the identification of discrepancies and ensures compliance with accounting standards.

General Journal vs. General Ledger

The journal, also known as the general journal, is involved in the first phase of accounting because all transactions are recorded in it, originally in chronological order. Your company probably has transactions that are repetitive and occur more frequently, such as sales and purchase transactions. While you may use the general journal to record these transactions, it could be cumbersome and sometimes result in a cluttered journal and a slow recording process prone to errors.

Transfer from the general journal to General Ledgers:

These entries typically include the date, accounts affected, and amounts. Understanding the structure and purpose of these entries is crucial for accountants and business owners alike. When using a manual accounting system, combination and special journals are great substitutes to the general journal as a convenient way of recording large numbers of similar transactions.

When the company purchased the vehicle, it spent cash and received a vehicle. Both of these accounts are asset accounts, so the overall accounting equation didn’t change. Total assets increased and decreased by the same amount, but an economic transaction still took place because the cash was essentially transferred into a vehicle. While these have been in practice since record-keeping was done, with advances in technology, nearly all companies, and even small businesses are using general journal format software. This software’s simple data entry logs these transactions in the journal and ledger accounts. Many of these software provides simple drop downs to record the transactions, thus making complex and tedious tasks very easy.

- It is the tool that you’ll always be using to enter the details of the transaction as inputs in the accounting system.

- We may earn a commission when you click on a link or make a purchase through the links on our site.

- These entries would then be totaled at the end of the period and transferred to the ledger.

- The information contained in a general journal can be used to help compile financial statements like income statements, balance sheets, and cash flow statements.

- Notice that the combination journal includes a miscellaneous column.

General ledgers are often organized into smaller groups or “sub ledgers.” These are dedicated to specific types of income and expenditures. For example, one sub ledger may contain information about the company’s sales. Another could be used for general purchases like office supplies or hardware. The how to calculate and record the bad debt expense General Journal is a catch-all journal where transactions that don’t fit into special categories are recorded. All modern GLs are computerized with accounting software like Quickbooks, so GL maintenance is pretty simple. Now that we know what is in the GL, let’s take a look at how it is formatted.

The general journal transaction entries always begin with a statement of the date that the transaction took place. The year, month, and date of a transaction are written in the date column. The year is entered immediately below the Date heading and is written once per page (that is, you don’t have to be repeating the year for every entry on the page). The process of recording transactions in the journal is referred to as journalizing. The general journal is the repository for transactions that a firm cannot specifically record in a particular journal.

For example, under a double-entry bookkeeping system, you record a sales transaction in both the cash account and the sales revenue account simultaneously. However, in a single-entry bookkeeping system, you’ll only have to record the sales transaction in the cash account, without affecting another account. Our accounting nominal journal template will help a business to document and post journal entries in a consistent, standard format setting out the required information listed above.

If you do end up making an error, you can easily find it by adding both sides of your journal entry together. If they do not equal the same number, you know that something has gone wrong. Whenever an event or transaction occurs, it is recorded in a journal. Journal can be of two types – a specialty journal and a general journal.

Double Entry Bookkeeping is here to provide you with free online information to help you learn and understand bookkeeping and introductory accounting. If financial statements are not put together in the correct order, then the information that they contain would be incorrect. Ensuring that you record dates properly will help keep your journal organized and accurate.

In the detail of the journal, key information that should be included is a line of the journal, date of the transactions, name of the account, and description of transactions. Additional information that should include is a reference and, more importantly, is debit and credit. The general journal is the book that entity firstly records all of the daily financial transactions in it. It is also called a book of original entries because all of the transactions are records in this book before moving to other books.