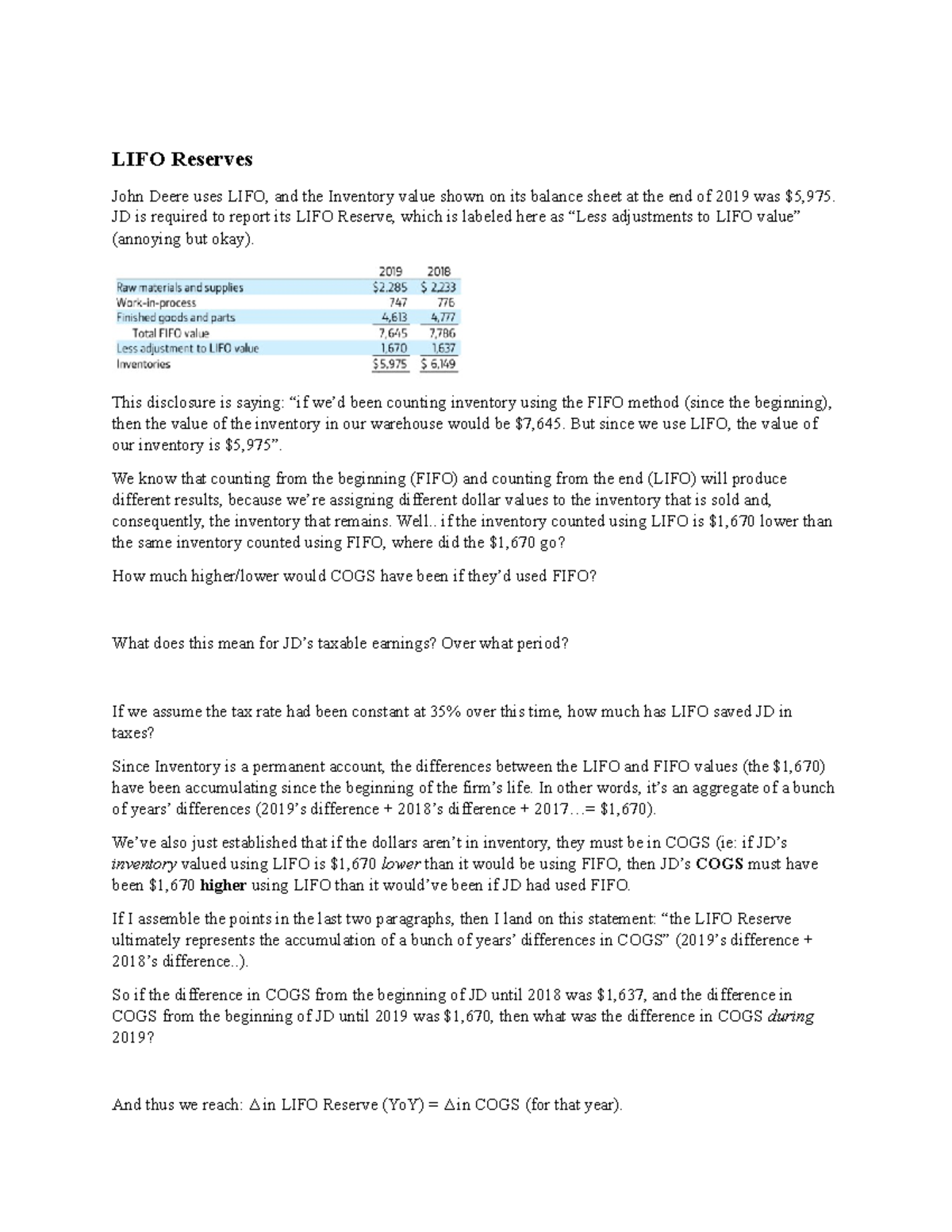

However, Adjusted Gross profit, Adjusted Operating expenses, EBITDA, Adjusted EBITDA, Adjusted EBITDA margin, Net Debt, Adjusted Net income and Adjusted Diluted EPS are non-GAAP financial measures regarding our operational performance and liquidity. These non-GAAP financial measures exclude the impact of certain items and, therefore, have not been calculated in accordance with GAAP. It is important for companies using the LIFO inventory valuation method to regularly monitor and promptly adjust their LIFO reserve to reflect accurate inventory levels. The LIFO reserve should be reviewed on at least a quarterly basis, comparing the current inventory quantities and costs against the base year LIFO inventory levels. Any material increases or decreases in inventory should trigger a corresponding adjustment in the LIFO reserve balance. Keeping the LIFO reserve up-to-date improves the accuracy of financial reporting and prevents distorted operational metrics.

LIFO Reserve Meaning and How to Calculate It

- Inflation is abnormally high across most sectors compared to the last few decades.

- Adjusted EBITDA margin was 4.7%, an increase of 27 basis points compared to the prior year.

- The credit balance in the LIFO reserve reports the difference since the time that LIFO was adopted.

- In summary, a declining LIFO reserve allows companies to gain some temporary benefit from liquidating old inventory in inflationary times.

- Last in, first out (LIFO) is only used in the United States where any of the three inventory-costing methods can be used under generally accepted accounting principles.

- These methods are FIFO(First In, First Out) Inventory, LIFO(Last In, First Out) Inventory, Specific Identification Method, and Weighted Average Cost.

We believe the presentation of Adjusted Diluted Earnings per Share is useful to investors because the measurement excludes amounts that we do not consider part of our core operating results when assessing our performance. The difference between the FIFO and LIFO cost of inventory for accounting purposes. The LIFO reserve is an account used to bridge the gap between FIFO and LIFO costs when a company is using FIFO but would like to report LIFO in its financial statements. Since the LIFO reserve increases the stated value of inventory, it lowers a company’s profit margin and affects metrics like return on assets.

Formula

Inflation is abnormally high across most sectors compared to the last few decades. These levels of increased cost are leaving many companies looking for ways to conserve cash and capital in other areas. It’s a non-cash item on the balance sheet and is used to adjust the financial statements to reflect the inventory’s lower value under FIFO. This adjustment helps provide a more accurate picture of a company’s financial position. The LIFO reserve account explains the difference between these two inventory valuation methods since the time LIFO was implemented. Thus, it plays a critical part in the fair presentation of inventory value within the financial statements and clearly discloses the impact of an organizations strategic valuation methodology.

Cash Flow Statement

Adjusted Gross profit is Gross profit adjusted to remove the impact of the LIFO inventory reserve adjustments. Adjusted Operating expenses are Operating expenses adjusted to exclude amounts that we do not consider part of our core operating results when assessing our performance. Given the LIFO reserve’s impact on earnings and profitability metrics, companies should communicate reserve changes and assumptions effectively in financial statement disclosures.

The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. The time that LIFO starts and the time that FIFO starts is of great significance if you want the result of your LIFO reserve to be accurate. If you want precision, you may take the LIFO reserve as far back as one year, along with a representation of how that year’s economy was.

Balance Sheet

Last in, first out (LIFO) is only used in the United States where any of the three inventory-costing methods can be used under generally accepted accounting principles. The International Financial Reporting Standards (IFRS), which is used in most countries, forbids the use of the LIFO method. The use of the term “reserve” in the LIFO reserve concept is discouraged, since it implies the recordation of a contra asset against the inventory line item in the balance sheet. Instead, a business could avoid the term by disclosing the “excess of FIFO over LIFO cost” on its balance sheet. A declining reserve is an important indicator that can be used for analyzing the profitability of a company and its sustainability.

We believe EBITDA, Adjusted EBITDA and Adjusted EBITDA margin provide meaningful supplemental information about our operating performance because they exclude amounts that we do not consider part of our core operating results when assessing our performance. EBITDA is Net income (loss), plus Interest expense-net, Income tax provision (benefit), and Depreciation and amortization. By using the what is irs form 8379 of company A, we can find the FIFO inventory and compare the current ratios of both companies. But there are certain ratios like inventory turnover ratios, inventory cycles, etc., that can only be compared if the same inventory method is used. These methods are FIFO(First In, First Out) Inventory, LIFO(Last In, First Out) Inventory, Specific Identification Method, and Weighted Average Cost.

This allows companies to better adjust their financial statements and budget in regards to sales, costs, taxes, and profits. EBITDA and Adjusted EBITDA are also used in connection with certain covenants and restricted activities under the agreements governing our indebtedness. We also believe these and similar non-GAAP financial measures are frequently used by securities analysts, investors, and other interested parties to evaluate companies in our industry. Cash flow provided by operating activities for the first nine months of fiscal year 2024 was $891 million, a decrease of $44 million from the prior year due to less working capital benefit than prior year. So in summary, the LIFO reserve is a simple mathematical calculation that captures the accounting and tax implications of using the LIFO inventory method. Tracking the LIFO reserve over time helps assess changes in inventory costs and deferred tax liabilities.

If this account balance changes, more costs will be assigned to cost of goods sold for the year causing reported profits to decrease. Investors can use this change to either calculate the tax benefits of using LIFO vs FIFO or see the results of inflation on inventory values. These items are uncertain, depend on various factors, and could have a material impact on GAAP reported results for the guidance periods.